Funding Today

Growing Everday

Flexible funding solutions tailored for your business growth – we’re always ready to listen, support, and provide the funding you need to move forward.

SNB Capital is a financial technology company, not a bank.

CHRIS POLLOCK

RASPBERRY MEDICAL

SNB Capital provided me with a $250k capital that truly saved my business

SANDY FRITZ

SUNSHINE MARKETING

SNB Capital really pulled through and helped us with our growth, when we needed

2550+ ORGANIZATIONS TRUSTED SNB Capital

SNB Capital OVERVIEW

The Financing You Need

To Grow Your Business.

From Financing To Strategy – SNB Capital Provides All-in-One Solutions To Take Your Business To The Next Level

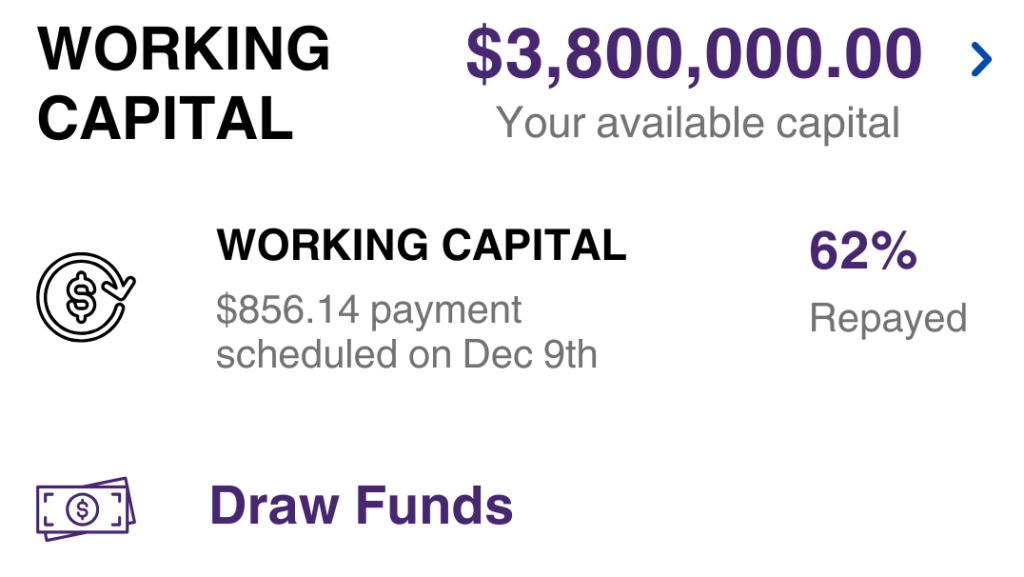

Working capital that powers your business.

Take advantage of competitive rates and tailored solutions to cover day-to-day operations and fuel your growth.

Starting at 8% APR

Affordable rates that make managing cash flow stress-free and cost-effective..

Same-day approvals

Get funds quickly with our streamlined process, to keep your business going.

Flexible repayment

options

Choose repayment terms that align perfectly with your revenue cycle for ease and flexibility.

Up to $5M in funding

Access the capital you need to scale, manage expenses, and seize new opportunities.

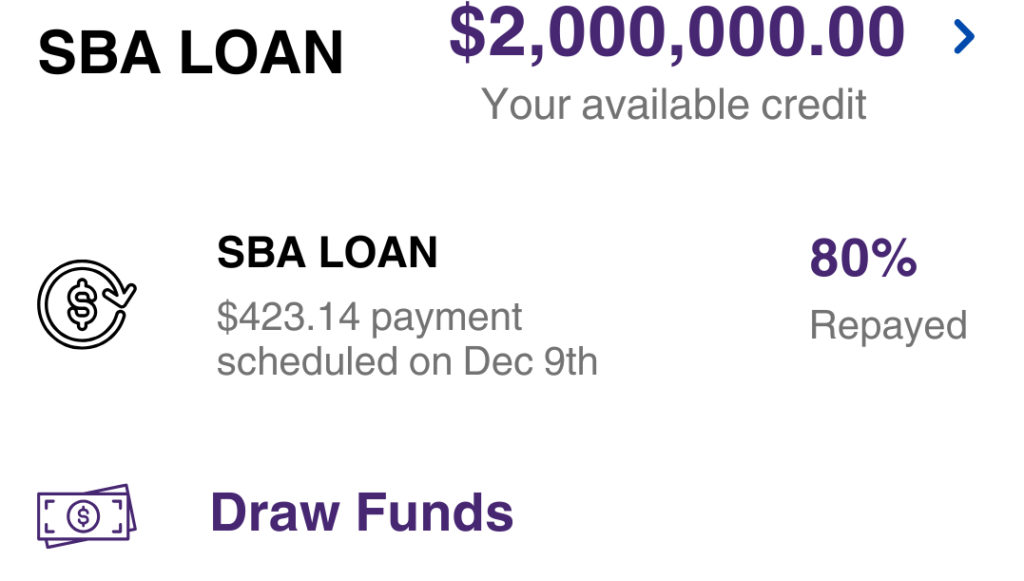

SBA loans designed to build your future.

Unlock long-term, low-interest funding to grow your business and achieve your big-picture goals.

Starting at 5.5% APR

Take advantage of some of the lowest rates in the market, designed to support sustainable growth.

Terms up to 10 yearss

Benefit from extended repayment periods to keep your monthly payments manageable.

Funding up to $25M

Access significant capital to expand operations, purchase equipment, or invest in your business’s future.

Backed by the SBA

Enjoy peace of mind with loans supported by the Small Business Administration, offering added security and stability.

A line of credit that adapts to your needs.

Flexible financing at your fingertips—borrow what you need, when you need it, and pay for what you use.

Starting at 1% Monthly

Access competitive rates designed to keep your financing affordable and efficient.

Revolving credit

Reuse your credit as you repay, ensuring funds are always available when opportunities arise.

Pay for what you use

No hidden fees—pay interest only on the amount you borrow, giving you full control over your finances.

Borrow up to $250K

Secure the capital you need to manage cash flow, inventory, or unexpected expenses.

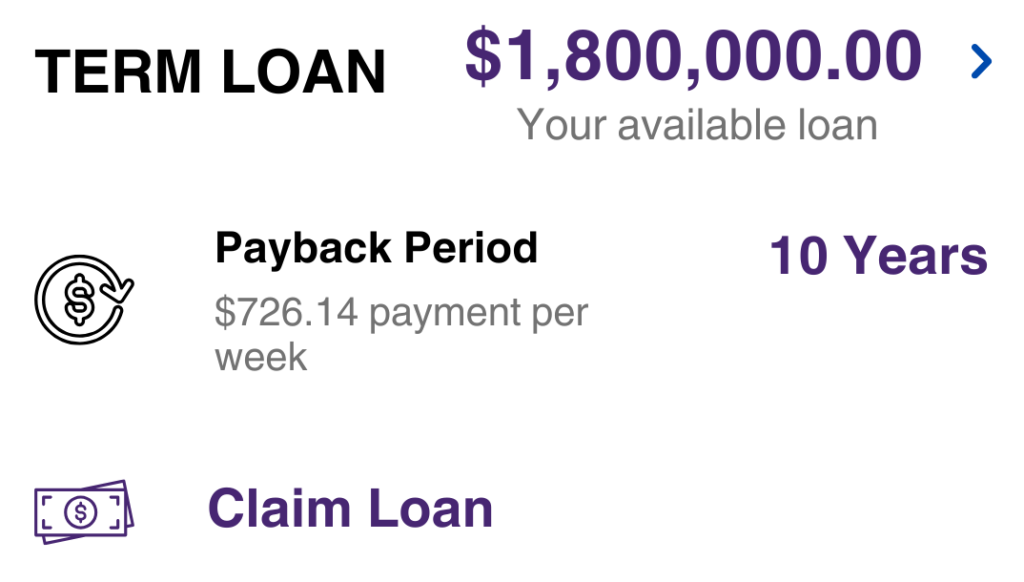

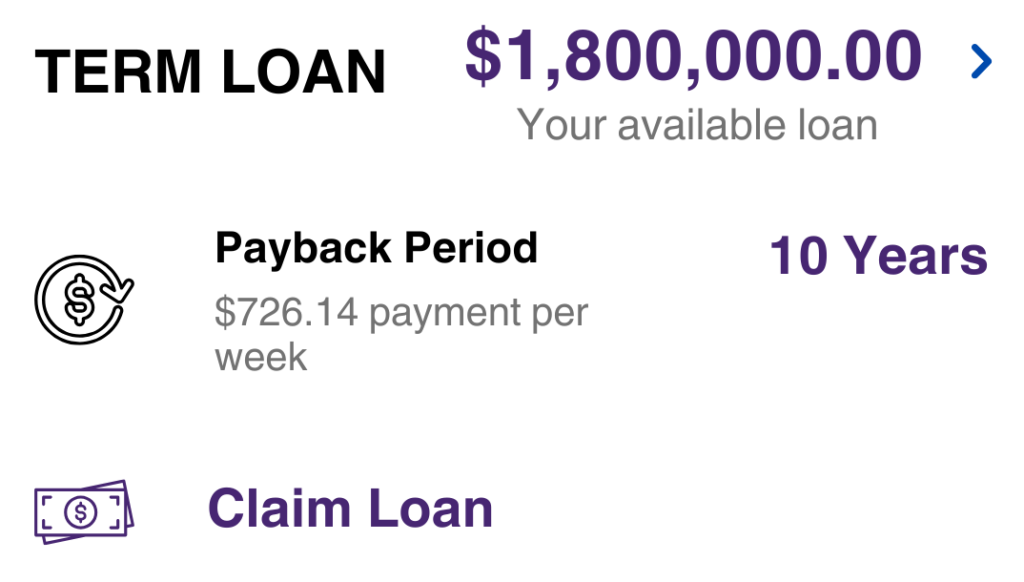

Term loans that fuel your growth.

Get the funding you need upfront, with predictable payments and terms that suit your business.

Starting at 6.5% APR

Lock in competitive rates to fund your goals without breaking the bank.

Loan amounts up to $5M

Secure the capital you need for expansion, equipment, or major investments.

Fixed terms up to 10 years

Plan with confidence using clear repayment schedules and consistent monthly payments.

Fast approvals

Move quickly on opportunities with a streamlined application process and rapid funding.

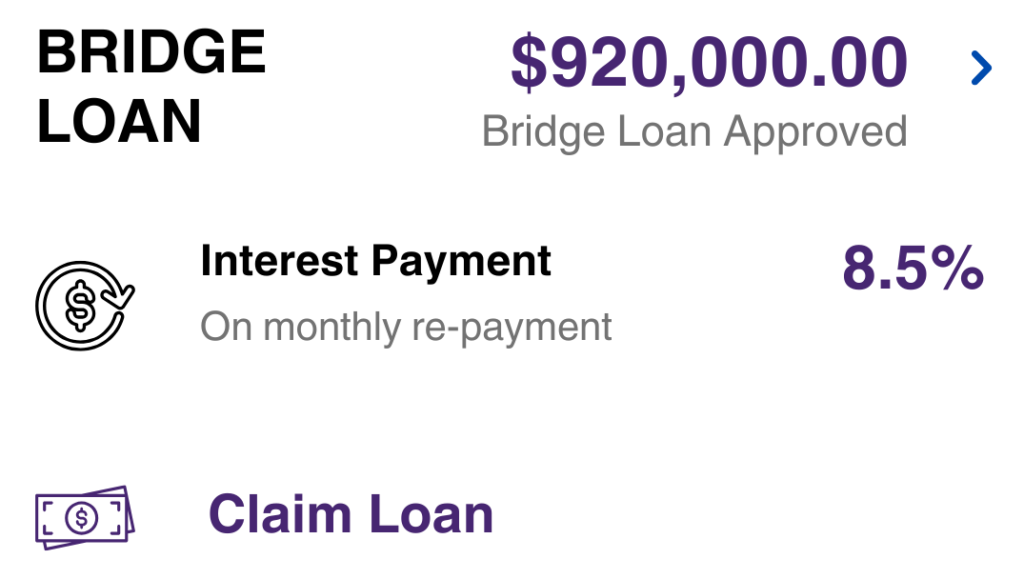

Bridge loans to keep your business moving.

Short-term financing to cover gaps and seize opportunities while waiting for long-term funding.

Starting at 8.5% APR

Affordable rates to help you manage cash flow during transitions or unexpected delays.

Funding up to $1M

Get the capital you need to cover payroll, inventory, or operational expenses.

Terms up to 24 months

Flexible short-term solutions designed to bridge financial gaps with ease.

Quick approvals

Access funds fast to ensure your business stays on track, no matter the challenge.

Looking For Real Estate Loans?

Explore flexible financing options designed to help you secure, build, or expand your real estate investments with ease.

Real Estate Loans: Build Your Business on Solid Ground

Investing in real estate requires capital—and we’re here to make it simple. Our Real Estate Loans offer flexible funding solutions for acquisitions, renovations, or expansions to help your business thrive.

Starting at 6.5% APR

Starting at 6.5% APR, we make real estate investments affordable.

Funding up to $5M

Secure the capital needed for property purchases, renovations, or expansion projects.

Terms up to 20 years

Enjoy long-term repayment options tailored to your business needs.

Streamlined Approval

Process

Get fast approvals and funding to capitalize on opportunities quickly.

Ground-Up Construction Loans

Whether you’re developing a new commercial property or residential project, our Ground-Up Construction Loans provide the funding and flexibility you need to bring your plans to life.

Mortgage Refinancing

Lower your interest rates, reduce monthly payments, or access cash from your home’s equity with our Mortgage Refinance —designed to give you greater control over your finances.

Industries We Serve

We understand that each industry has its own challenges and opportunities, so we provide customized programs designed specifically for your business type

Empowering business to grow

SNB Capital is more than just a financing platform—they became a trusted partner in helping us understand and optimize our business finances. Their team worked closely with us to analyze our cash flow and identify areas where we could save and invest more effectively. Thanks to them, we’ve streamlined our operations, reduced unnecessary expenses, and improved profitability.

Katelin Holloway — Founding Partner, 776

12000+

Organizations use SNB Capital to better manage business financials and grow the business.

SNB Capital is the top choice for small

businesses

Their quick approval process and transparent terms made securing a working capital stress-free. They’re always available to answer questions and genuinely care about your success.

Emily Rodgers

CEO

Rodgers & Co

28+ Employees

Term loans from SNB Capital helped us invest in new equipment and expand our team. Their clear communication, fast approvals, and competitive rates set them apart from other lenders.

Kae Bandoy

CFO

TechCore Inc.

20+ employees

Our cash flow was tight due to unexpected expenses, but the line of credit from SNB Capital came through just in time. It was super flexible and has made a huge different

Sara Thompson

CFO

Thompson Interiors

170+ employees

We ultimately we went with SNB Capital because they got us the best rates we got, and the cash was in the bank in a day! Can’t recommend them enough”

Jim Garcia

People Coordinator

Speedy's

10+ employees

Learn best practices from people

operations experts

Finance Blog By SNB Capital

Resources for small businesses designed to help business owners to understand financing, and growth.

SNB Capital University

Resources for small businesses designed to help business owners to understand financing, and growth.