2550+ ORGANIZATIONS TRUSTED SNB Capital

What is an SBA Loan

An SBA loan is a financing option for small businesses, partially guaranteed by the U.S. Small Business Administration (SBA). This guarantee reduces the risk for lenders, encouraging them to provide loans to small businesses that might not qualify for traditional financing.

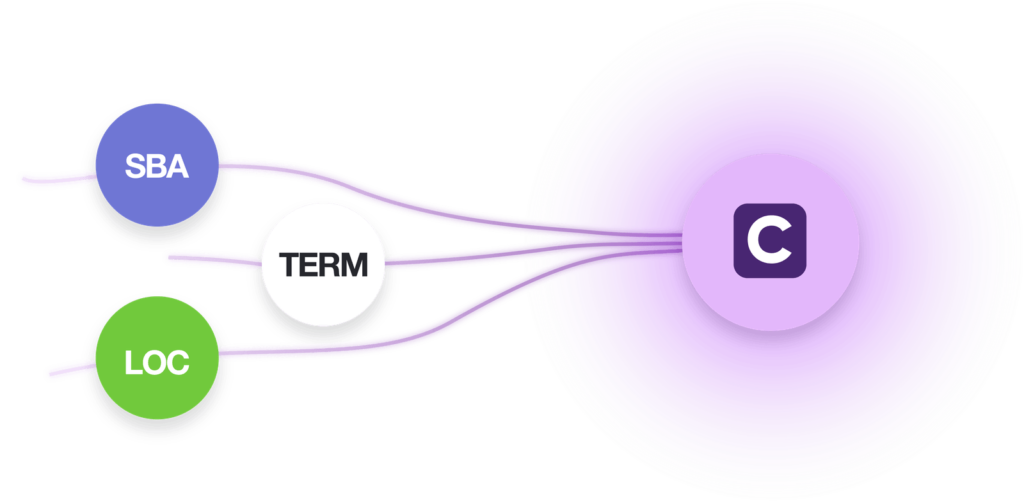

The common types of SBA loans are:

7(a) Loan Program:

The SBA's primary program for general business financing needs, offering loans up to $5 million for working capital, expansion, equipment purchases, and more.

504 Loan Program:

Provides long-term, fixed-rate financing up to $5.5 million for major fixed assets like real estate or equipment.

Microloans:

Offers loans up to $50,000 to help small businesses and certain non-profit childcare centers start up and expand.

Why Choose SBA Loans

Experience low-interest rates, extended repayment terms, and the backing of the Small Business Administration—funding designed to help your business thrive.

Starting at 5.5% APR

Take advantage of some of the lowest rates in the market, designed to support sustainable growth.

Terms up to 10 years

Benefit from extended repayment periods to keep your monthly payments manageable.

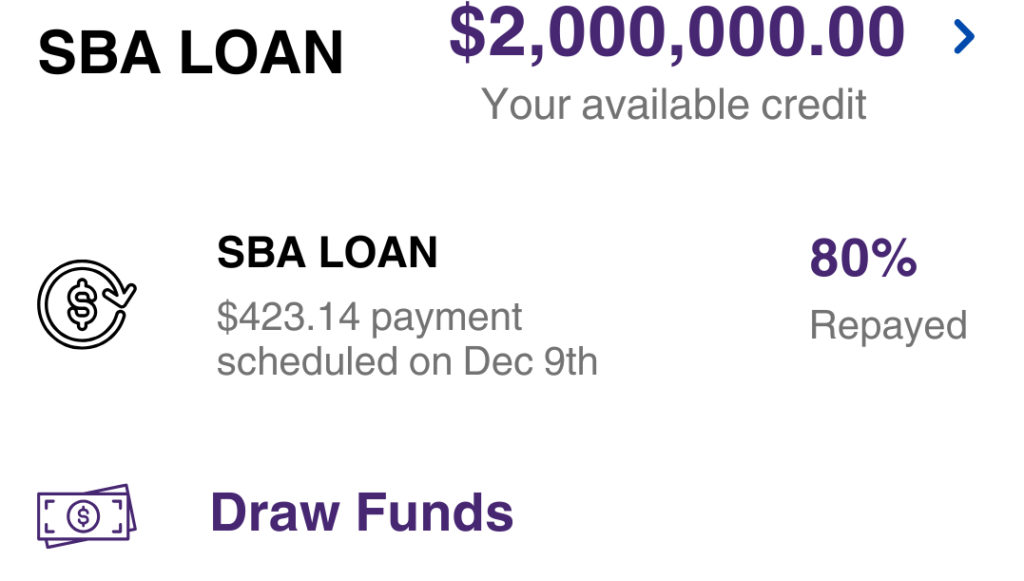

Funding up to $25M

Access significant capital to expand operations, purchase equipment, or invest in your business’s future.

Backed by the SBA

Enjoy peace of mind with loans supported by the Small Business Administration, offering added security and stability.

SNB Capital is the top choice for small

businesses

Their quick approval process and transparent terms made securing a working capital stress-free. They’re always available to answer questions and genuinely care about your success.

Emily Rodgers

CEO

Rodgers & Co

28+ Employees

Term loans from SNB Capital helped us invest in new equipment and expand our team. Their clear communication, fast approvals, and competitive rates set them apart from other lenders.

Kae Bandoy

CFO

TechCore Inc.

20+ employees

Our cash flow was tight due to unexpected expenses, but the line of credit from SNB Capital came through just in time. It was super flexible and has made a huge different

Sara Thompson

CFO

Thompson Interiors

170+ employees

We ultimately we went with SNB Capital because they got us the best rates we got, and the cash was in the bank in a day! Can’t recommend them enough”

Jim Garcia

People Coordinator

Speedy's

10+ employees